Filing for bankruptcy is a serious decision that can provide relief from overwhelming debt but also has long-term consequences. If you’re considering bankruptcy in New Jersey, understanding the process and what to expect is essential. This guide will help you navigate the key steps and considerations involved in filing for bankruptcy in New Jersey.

Types of Bankruptcy

In New Jersey, the two most common types of bankruptcy for individuals are Chapter 7 and Chapter 13. Each type has different eligibility requirements, benefits, and implications.

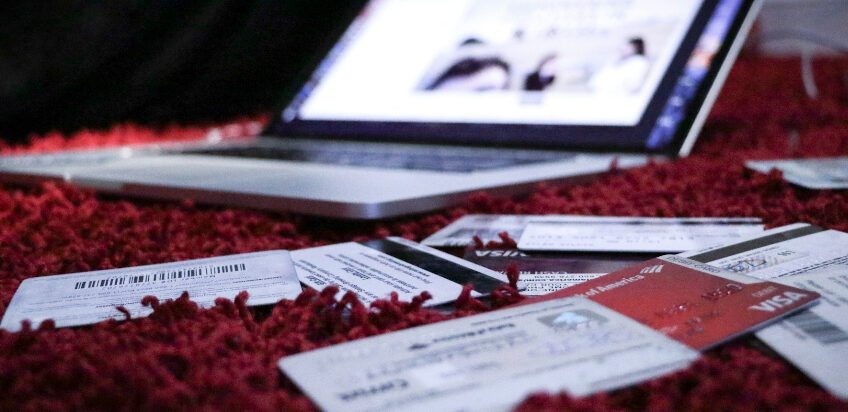

- Chapter 7 Bankruptcy: Known as liquidation bankruptcy, Chapter 7 allows you to discharge most of your unsecured debts, such as credit card debt and medical bills. In return, you may have to sell some of your assets to repay creditors. However, New Jersey offers exemptions that allow you to protect certain property, such as your home, car, and personal belongings, up to specific limits.

- Chapter 13 Bankruptcy: Also known as reorganization bankruptcy, Chapter 13 allows you to keep your property while repaying your debts over a three- to five-year period. This option is often chosen by individuals who have a steady income but are struggling to keep up with their debt payments. Chapter 13 can be a good option if you want to avoid foreclosure on your home or repossession of your car.

Eligibility Requirements

Not everyone qualifies for Chapter 7 or Chapter 13 bankruptcy. Eligibility for Chapter 7 is determined by a means test, which compares your income to the median income in New Jersey. If your income is below the median, you may qualify for Chapter 7. If it’s above, you may still qualify after deducting certain expenses, or you may need to file for Chapter 13 instead.

For Chapter 13, you must have a regular income and your debts must fall within specific limits. As of 2023, your unsecured debts (like credit cards) must be less than $465,275, and your secured debts (like mortgages) must be less than $1,395,875.

The Bankruptcy Process

Filing for bankruptcy involves several steps, and it’s important to be prepared for each phase of the process.

- Credit Counseling: Before you can file for bankruptcy, you must complete a credit counseling course from an approved agency. This course helps you understand your financial situation and explore alternatives to bankruptcy.

- Filing the Petition: Once you’ve completed credit counseling, you’ll need to file a bankruptcy petition with the U.S. Bankruptcy Court for the District of New Jersey. The petition includes detailed information about your debts, assets, income, and expenses.

- Automatic Stay: After filing your petition, an automatic stay goes into effect. This legal protection stops creditors from pursuing collection actions, such as lawsuits, wage garnishments, and foreclosure, while your bankruptcy case is pending.

- Meeting of Creditors: About a month after filing, you’ll attend a 341 meeting, where you’ll meet with the bankruptcy trustee and your creditors. The trustee will review your petition, ask questions, and discuss how your debts will be handled. Creditors may also ask questions, although they rarely attend.

- Discharge or Repayment Plan: In Chapter 7 bankruptcy, if all goes smoothly, you’ll receive a discharge of your eligible debts within a few months. In Chapter 13, you’ll begin making payments according to your repayment plan, which lasts three to five years. After completing the plan, any remaining eligible debts will be discharged.

Exemptions in New Jersey

One of the most critical aspects of bankruptcy is understanding what property you can protect. New Jersey allows you to choose between federal and state exemptions when filing for bankruptcy. These exemptions determine which assets you can keep during the bankruptcy process.

- Homestead Exemption: Unlike many states, New Jersey does not offer a specific homestead exemption under state law. However, you can use the federal homestead exemption, which protects up to $27,900 of equity in your primary residence (as of 2023).

- Personal Property Exemptions: Both federal and New Jersey state exemptions allow you to protect certain personal property, such as clothing, household goods, and tools of the trade.

- Wildcard Exemption: The federal wildcard exemption allows you to protect any property of your choosing up to a certain value, which can be particularly useful if you have assets that don’t fall under other exemption categories.

Impact on Your Credit

Filing for bankruptcy will have a significant impact on your credit score. A Chapter 7 bankruptcy remains on your credit report for 10 years, while a Chapter 13 bankruptcy stays on your report for seven years. During this time, you may find it more challenging to obtain new credit, and you may face higher interest rates when you do.

However, many people find that their credit begins to improve over time as they rebuild their financial lives. Some creditors may be willing to offer new lines of credit after you’ve demonstrated responsible financial behavior post-bankruptcy.

Life After Bankruptcy

Filing for bankruptcy gives you a fresh start, but it’s important to take steps to rebuild your financial health after the process is complete.

- Create a Budget: Developing and sticking to a budget will help you manage your finances and avoid falling into debt again.

- Rebuild Credit: Secured credit cards and responsible use of credit can help you rebuild your credit score over time.

- Save for the Future: Building an emergency fund and saving for future expenses can provide financial security and prevent the need for future bankruptcy filings.

Conclusion

Filing for bankruptcy in New Jersey is a complex legal process that can provide much-needed relief from overwhelming debt. Understanding your options and what to expect is crucial to making informed decisions about your financial future. If you’re considering bankruptcy, it’s essential to consult with an experienced bankruptcy attorney who can guide you through the process, help you protect your assets, and ensure that you achieve the best possible outcome.